Why use blockchain? Blockchains are useful for many things, and it can be tricky to define them in simple terms without a technical definition. There’s also a risk of oversimplification.

How would you answer the question, “What is a database good for?” Let’s give it a go:

Database: storing and retrieving data quickly.

Distributed Ledger: storing, retrieving and updating an agreed source of truth. Consider this: by definition, centralised systems create data silos. Whereas blockchains are:

Shared by default. Data is guaranteed to be accurate and available.

Programmable by default. Blockchains don’t use separate APIs.

Better Management of "Digital" Assets

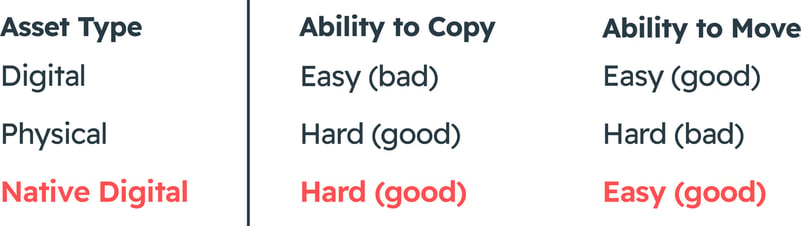

One of the fundamental properties of modern computing is that data is straightforward to duplicate. The ability to copy and transmit information with stunningly low cost and high reliability was the very innovation that ushered in the information age. However, this generated a side-effect: when digitising something of value (an asset), the digital representation of the asset can also now be easily copied and transmitted.

Here’s an explanation on how to manage digital assets:

Consider a ‘digital’ asset to be an entry on a database representing $1 million.

And now consider a physical asset being a bar of gold.

A natively digital asset (aka “tokenised” asset) converges the best properties of both.

NOTE: some in the industry use the word tokenised to mean an asset as a bearer-instrument. We use tokenisation here in the general sense to represent an asset deployed onto a blockchain, thereby giving it the programmable-source-of-truth property we desire.

Fundamentally, an asset is a thing of agreed value by a group (network) of entities (companies, people), and such an asset can be represented on a ledger.

Better Management of "Digital" Assets

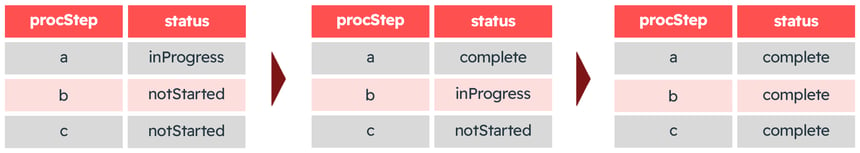

Better Management of Shared Processes

In the same way, the current state of a process can be tracked and updated with a complete and agreed history of progress. Over time, this will also reveal external bottlenecks that can be targeted for further optimisation.

Using blockchain means the information about who owns what things of value is the same for everyone, i.e. the “truth” about the current state of affairs is indisputable.

Why use blockchain? The critical insight here is that we can converge a (legal) product with its digital representation rather than having them separate. Take, for example, a new personal loan - the origination of a new financial asset. A distributed ledger can entirely represent the loan, including the terms and conditions, offer and acceptance, and history of repayments. Furthermore, now that this asset is programmable, it can be distributed (shared) with others, making it a trivial matter to bundle a group of such loans and resell them as new securities, with a full look-through back to the underlying asset for the investor, all perfectly synchronised within seconds. These securitised assets can then be traded further down the value chain by extending the ledger, and so it goes.

Why use Redbelly? The Redbelly Network is a revolutionary open finance platform that embeds distributed ledger technology into the heart of financial relationships. With a novel leaderless consensus mechanism, democratic byzantine fault tolerant (DBFT) consensus developed with The University of Sydney and CSIRO’s Data61, we can achieve high performance and guarantee the impossibility of forking and mitigate double spending with near-instant finality. This eliminates information asymmetry and dramatically increases efficiency, helping to build a fairer financial system for all.

The Redbelly Network is designed to focus on accountability. Accountability is enforced at a protocol level through a novel mechanism that constructs undeniable proofs of fraud - Polygraph; and at the functional level through an innovative identity layer that ensures all network participants are known.

Through standards-based smart contract templates, real-world financial relationships are deployed as Ricardian contracts on the Redbelly Network, thereby benefiting from reduced information asymmetry, considerable gains in efficiency, low and known transaction costs, as well as the accountability afforded by legal and regulatory enforcement that is required for any real-world financial relationship.

Using blockchain for an Executive Technology Strategy is crucial. Consensus-based data replication can be beneficial, particularly in managing digital assets, public information, and inter-business workflow. It’s no accident that the term smart contracts invites comparison with more prosaic “legal” contracts (although many in the blockchain space concur that smart contracts are a lot more like dumb programs). The critical difference is that they run autonomously, or in other words, across multiple nodes at the same time independent of any one operator, giving each node complete assurance that the data they see is the same as what their counterparties see.

Redbelly has been designed to natively support the deployment of Ricardian contracts where a hash of the full legal agreement is referenced in a smart contract’s code to irrefutably link the real-world relationship (legal contract) with the execution of a subset of its rights and obligations (the smart contract). Templates of high-value financial relationships will aid in the ease of deployment. Our Ricardian contracts benefit from the automation, efficiency and transparency of smart contracts and provide real-world compliance and enforceability. In addition to the Ricardian contract templates, tools will be built to aid the development of novel relationships and programmed dependencies between existing relationships in a concept we call ‘value webs’.

Staying Relevant

The benefits and potential have been publicly recognised:

Paul Brody, Global Blockchain Leader, EY - “Blockchains will do for networks of businesses what ERP did for the single enterprise.”

Hon Karen Andrews, Minister for Industry, Science and Innovation - “Blockchain is a technology with real potential to save businesses money and to open new business and export opportunities.”

Centralised systems create data silos. Blockchain offers an alternative to APIs for data sharing.

Remember, Blockchain enables business relationships to operate at the speed of consensus (mere seconds), which is much faster when you can rely on the information as soon as it appears.

Message-based systems (APIs) work by your counterparty hiding information, and you need to trust what you're told.

State-based systems (blockchain) work by your counterparty, showing you the information so you can see for yourself.