Redbelly Network, the world's first public and purpose-built real-world asset tokenisation network, has announced the launch of both its testnet platform, a significant step towards its mainnet launch later in 2024, and the massive pipeline of assets it is working to move on-chain.

Originating from academic research backed by CSIRO and the University of Sydney, Redbelly is the result of more than seven years of dedicated software and infrastructure development. This has been combined with the construction of a network of global partners such as node operators, exchanges and oracles.

As interest in its innovative RWA solution has grown rapidly, multiple different tokenisation customers have explored how it solves the KYC, AML and CTF regulations in their own industries. Now these customers have signed contracts to participate in Testnet and bring a total of more than $73.8B USD in assets onto their chain. This would make Redbelly the number 1 global chain in terms of RWA TVL (total value locked) within the next year.

Redbelly has already announced publicly that both private equity and rent roll tokenisation solutions are being built for customers Liquidise and Hutly. Since those announcements, further use cases and commitments from existing customers have been secured, as well as agreements with several major new customers yet to be announced. This gives Redbelly a pipeline of more than 73.8 Billion dollars in assets to be moved onto its chain, more than the current RWA TVL of global networks such as Ethereum.

Redbelly’s Executive Chairman Alan Burt says that this is a significant step forward not just for the business but also for tokenisation as a whole.

“The growth benefits and operating efficiencies from real world asset tokenization continue to drive massive interest from the world’s most famous asset owners and issuers, as well as from wholesale, sophisticated and retail investors. It’s a trillion dollar opportunity for the right solution.

We have built Redbelly from scratch, addressing all of the issues that prevent other networks from providing composable, compliant and open solutions, and the level of interest in our project is a reflection of the quality of what we have built.”

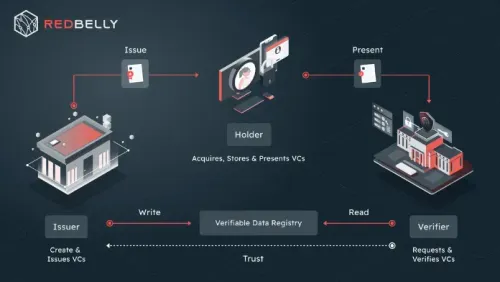

Redbelly’s founder and CTO Vincent Gramoli, who spoke about Compliant Asset Tokenisation this month at the Google Cloud Summit, says that Redbelly’s focus on user identity and accountability is its biggest differentiator.

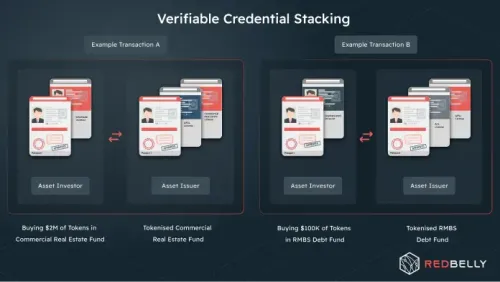

“What we have built, and what users can today start to test for themselves, is the world's first public, purpose-built real-world asset tokenisation network. Yes it has multiple layers of market-leading security and yes it’s blazingly fast, but the biggest difference is that it has user accountability and identity built at its core.

This means we enable asset owners, issuers and investors to work with their local regulatory frameworks and legal jurisdictions, not against them. We protect our users and their assets.”

Plans are in place for tens of thousands of users to be onboarded onto the network over the next few months, as Redbelly’s customers and community get the opportunity to test and validate Redbelly’s exciting new technology. Alan Burt says that this is because it is the first time a compliant solution has been made a reality.

“I could not be prouder, this is a huge deal for the team, our customers and the entire world of RWA tokenisation. We are now able to help bring all of the benefits of tokenisation to new markets, new customers, new investors, providing new liquidity and economic opportunity.

By giving asset owners and issuers the compliant composability they need to meet their regulatory obligations, it's only by using our network that the global tokenisation vision can finally be realised.”